QuickBooks® Desktop Plus 2022 includes features that benefit business with improved money management, data sync, and processing speed improvements.

QuickBooks Desktop 2022 subscription offering

Note: QuickBooks Desktop will now only be selling its Pro, Premier, and Mac products as Pro Plus, Premier Plus, and Mac Plus subscriptions. QuickBooks Desktop Enterprise has been a subscription offering for a few years. Businesses will now have the following benefits of having QuickBooks Desktop as a subscription. The following are features included with the QuickBooks Desktop Pro Plus and Premier Plus (Windows) editions:

Access to the latest version, with the most up-to-date features, security patches, and support for third-party operating system changes1.

Up to 38% faster, more reliable QuickBooks computing power (64-bit)2.

Unlimited customer support and data recovery at no additional charge (a $299.99 annual value)3.

Premium time saving and money management features.

Increased productivity with the QuickBooks Desktop mobile app.*

*QuickBooks Desktop 2022 mobile app features will be available as of 10/12/2021.

Intuit account requirements for QuickBooks Desktop

Included with: QuickBooks Desktop Pro Plus, Premier Plus, and Accountant Plus 2021. All editions of Desktop Enterprise 22.0.

Note: Beginning with QuickBooks Desktop 2021 maintenance release 5 and newer, an improved user experience and security protocol was introduced. The requirement is needed to take advantage of many of the new features detailed in this article. QuickBooks requires that the Company owner log in to an Intuit® account as prompted when opening the Company file with the Admin user credentials.

Having an Intuit account provides a secure, single source login for access to all of Intuit’s powerful offerings, including owned QuickBooks Desktop software and connected services.

You can learn more about this functionality by reading this article or by watching this video.

Accessible: The steps mentioned here will help business owners give additional users access to the integrated apps via the Intuit account. Log into the QuickBooks file with the Admin credentials, and then from the menu bar, select Company > Set Up Users and Passwords > Intuit Account User Management. Users set up here will have access to selected integrated apps, but will not have access to the QuickBooks Company file. To grant access and rights to the Company file, from the menu bar, select Company > Set Up Users and Passwords > Set Up Users (QuickBooks Pro Plus and Premier Plus). For QuickBooks Desktop Enterprise from the menu bar, select Company > Users > Set Up Users and Roles.

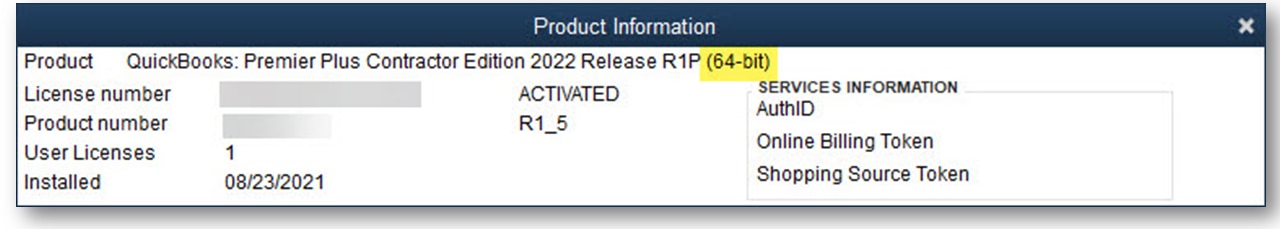

NEW! Enhanced computing power (64-bit compliant)

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022 and all editions of Desktop Enterprise 22.0.

Accessible: Users will only be able to install QuickBooks Desktop 2022 for computers running 64-bit Windows. To confirm the successful install of 64-bit, launch QuickBooks Desktop. Using a Windows keyboard select the F2 key. The Product Information window displays. At the top and center of this window, you will see your product edition, maintenance release, and “(64-bit)” listed.

Features: QuickBooks is noticeably quicker, which allows users to complete accounting tasks faster. Enhanced computer power with 64-bit helps to stay compliant with modern operating system standards. 64-bit computer power will help to maintain seamless third-party integrations by utilizing preferred developer infrastructure.

Note: Desktop 2022 is not compatible with 32-bit computing. Customers on 32-bit software and hardware must upgrade to 64-bit compatible hardware and software to be able to use QuickBooks Desktop 2022. See QuickBooks Desktop 2022 system requirements.

NEW! Upload vendor invoices via mobile device and auto-create bills for review

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022, and all editions of Desktop Enterprise 22.0. The QuickBooks Desktop app is available for Android and Apple mobile devices, as of Oct. 12, 2021.

Accessible: There are multiple access points. From a mobile device, open the QuickBooks Desktop app, log in, and select Snap and Upload Bill. See this how-to video. From an open QuickBooks Company file, from the menu bar, select Vendors > Upload and Review Bills.

Features: Snap a picture of a vendor bill using the QuickBooks Desktop mobile app or request that your vendor email their invoices directly to your customized QuickBooks email. Using algorithms for artificial intelligence/machine learning, QuickBooks Desktop will create a vendor bill transaction from the uploaded vendor invoice for your review and approval. QuickBooks will store the digital copy of the bill to the computer where the QuickBooks Desktop file is stored.

Note: Only users included in the Intuit account associated with the QuickBooks Desktop Company file will be permitted to email or upload vendor bills. For more information refer to the previous topic on the Intuit account mandate in this article.

NEW! Pay bills online with Melio® from within QuickBooks

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022, and all editions of Desktop Enterprise 22.0.

Accessible: From the menu bar, select Vendors > Pay Bills. Optionally, from a displayed vendor bill, select Schedule Online Payment found on the top right of the main ribbon.

Note: If paying a vendor bill with a payment type that includes a separate processing fee, QuickBooks will create a vendor named Melio and these charges will be added as a vendor bill. As the charges are deducted from your funding source, QuickBooks will record the fee bill as paid. Optionally, on demand, users can select from the menu bar, Sync Online Bill Payments to sync these details with the QuickBooks Company file.

Features: Using services provided by Melio4, schedule vendor payments online from within QuickBooks. Assign a specific day for the payment to be processed and sent. The QuickBooks user can choose to pay their vendor bills by any of the following methods: ACH, debit, or credit card. Separately, you can choose how your vendor will receive the payment – as a deposit in their bank account (ACH) or as a paper check. Vendor payment details are securely recorded with Melio and not in the QuickBooks Desktop Company file. Once the payment is processed, QuickBooks marks the bill as paid, for easy visual confirmation. Take a look at this video on how to pay bills online with QuickBooks Desktop.

NEW! Accounts payable approval process

Included with: All editions of QuickBooks Desktop Enterprise 22.0.

Accessible: From the menu bar in QuickBooks Desktop Enterprise, select Company > Track and Approve Transactions.

Features: Manage cash flow by defining a customizable approval process for vendor bills received. Confidently delegate accounts payable tasks, knowing you have an established bill approval process before a vendor bill can be processed for payment. The convenient dashboard organizes those bills that require specific approval before being paid. Both the accounts payable clerk and selected approvers receive emails keeping them informed of the status of vendor bills. For a video on how to set up custom bill approval workflows, click here.

NEW! Customize and email vendor bill payment stubs

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022, and all editions of Desktop Enterprise 22.0.

Accessible: To modify the bill payment stub, from the menu bar, select Lists > Templates and select the Bill Payment template. Optionally, from a displayed vendor bill payment transaction, on the formatting ribbon select Manage Templates. Print the newly customized Bill Payment Stub from the Payment Summary window or optionally, from the menu bar, select File > Print Forms > Bill Payment Stubs.

Features: Maintain professional and consistent communications by emailing customizable bill payment stubs to your vendors. Modify the bill payment stub to include your business logo, along with details of the payment made in QuickBooks.

NEW! Attach documents to QuickBooks using a mobile device

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022, and all editions of Desktop Enterprise 22.0. The QuickBooks Desktop app is available for Android and Apple mobile devices, as of Oct. 12, 2021.

Accessible: From a mobile device, log into the QuickBooks Desktop app (free) and select Document, then follow the prompts.

Features: Conveniently snap a picture of document(s) with the free QuickBooks Desktop mobile app. Or optionally scan documents into the QuickBooks Desktop Attachment Center. Attach these documents efficiently to transactions or records eliminating the need to keep paper copies.

NEW! Choose from multiple email customer contacts

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022, and all editions of Desktop Enterprise 22.0.

Accessible: From the menu bar, select Customers > Customer Center. Select the customer record for which you want to create multiple email addresses. From a displayed Customer invoice, select email or from the menu bar, select File > Send Forms.

Features: Emailing your customers their invoices from within QuickBooks? Efficiently choose email(s) from a drop-down selection of the emails associated with your customer’s record.

NEW! Add-on e-Commerce integration powered by Webgility®

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022, and all editions of Desktop Enterprise 22.0.

Accessible: Available as an add-on for an additional fee. From the menu bar, select Company > My Company.

Features: For QuickBooks Desktop users with an online storefront presence. Webgility5 is an industry leading platform that integrates with QuickBooks Desktop to simplify e-commerce management. With three different packages to choose from (Core, Classic, and Deluxe), this add-on provides a seamless e-commerce integration with top online stores such as Shopify, WooCommerce, Big Commerce, Magento and industry-leading online marketplaces like eBay, Amazon, and Walmart.com. Easily add new product listings and update inventory management details to your online channels. It includes the flexibility to work with your preferred shipping provider, with integrations to UPS, FedEx, ShipStation, and Stamps.com.

NEW! Payment links for customer pre-payments

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022 and all editions of Desktop Enterprise 22.0 with an active QuickBooks Payments6 account.

Accessible: From the menu bar, select Customers > Payment Links. Or optionally, from the Home Page > Payment Links.

Features: Request money from your customer as a “deposit” for services and or products not yet provided without sending an invoice. Email the link to the customer for them to process the payment without having to receive an invoice. Users can track the payment links sent in QuickBooks. When the payment is received QuickBooks will record the payment as an unapplied customer credit in the Accounts Receivable account.

NEW! Instant deposits for QuickBooks Payments account users

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant 2021, and Desktop Enterprise 22.0. Maintenance release 5 and newer with an active QuickBooks Payments7 account.

Accessible: From the menu bar, select Customers > Billing Solutions > Download Payments. There are multiple access points in QuickBooks Desktop. Setup requires only debit card details and a one-time verification.

Features: Merchant payments can be instantly deposited into the business bank account. Quicker funding helps the business manage their day-to-day expenses. Review the Instant Deposit details (available balance, connected debit card, fees, etc.) and accept the deposit in a single step.

NEW! Next day direct deposit for Assisted Payroll subscribers

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022 and all editions of Desktop Enterprise 22.0 with an active Assisted Payroll8 subscription.

Accessible: When processing payroll with an active Assisted Payroll subscription.

Features: Pay employees faster and keep funds for longer in the business bank account; process payroll any time before 5pm (PT) the day before payday. The business owner processes payroll one day before payday. Funds will be debited from the bank account on payday.

NEW! Simplified Assisted Payroll activation

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022 and all editions of Desktop Enterprise 22.0 with an active Assisted Payroll subscription.

Features: Set up Assisted Payroll easily and get to your first payroll faster with a streamlined and well-guided assisted payroll activation process. Fewer steps are now needed in setting up Assisted Payroll in QuickBooks Desktop Plus.

NEW! Discovery hub

Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022, and all editions of Desktop Enterprise 22.0.

Accessible: From the top right, on the menu bar, select Discovery Hub.

Features: Preview of new features included with the release of QuickBooks Desktop Plus 2022.

NEW & IMPROVED! QuickBooks Desktop Mac Plus 2022

Note: QuickBooks Desktop Mac 2022 is transitioning to a subscription model, and will now be called QuickBooks Desktop Mac Plus. Businesses will now have the following benefits of having QuickBooks Desktop Mac Plus:

Access to the latest version, with the most up-to-date features, security patches, and support for third-party operating system changes9

Unlimited customer support10

Data recovery11

Premium time saving and money management features

Unlimited customer support – Access to live customer support through convenient messaging and call-back options, at no additional cost.

Improved bank feeds12 – Automatically categorize bank transactions with more detail by using enhanced rules, batch editing, and improved matching.

Receipt Management – Automatically create and categorize receipt expense transactions in QuickBooks by directly importing receipt data from your iPhone or a PDF.

Automatically send customer statements – Automate the process of creating statement reminders to send to your clients.

Apple silicon processor compatibility – Accomplish your accounting tasks faster with a QuickBooks optimized to work with legacy Intel processor-based Macs, and the latest Apple Silicon processor-based Macs.

Create customer groups – Create rule-based customer groups based on fields like customer type, status, location and balance, so you can easily manage and communicate with customers.

Choose from multiple email contacts – Send emails more quickly by choosing the right recipients from a list of your customer or vendor contacts.

Transaction improvements – Save time managing transaction details with easy to reference reconciliation status and one-click export to Microsoft Excel.

Collapse report columns & rows – Hide columns and rows to see simple, easy to read totals in reports with jobs & classes.

Disclaimers

1Upgrades to a new version will be provided if and when they become available.

2Based on lab testing vs. prior QuickBooks Desktop (32-bit) versions using a 1GB average file size. Average speed improvement was observed when running “Report Profit and Loss Detail Accrual.” An average speed improvement of 31% was observed on a 400MB file when running “Custom Transaction Detail Accrual Report.” Actual results may vary.

3Available from 6am-6pm Mon-Fri (PT) for Pro, Premier and Plus customers. Enterprise access available 24/7. Hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. Holidays, and events beyond our control. Access to messaging with live experts or call back support requires a QuickBooks Care Plan, and an internet connection. Care plan is included with Plus and Enterprise subscriptions. A la carte Annual Care Plan MSRP is $299.99.

4Additional fees apply when paying with a credit card, or when using optional Fast ACH and Fast Check expedite services.

5E-commerce integration requires an active and current version subscription of QuickBooks Pro Plus, Premier Plus or Enterprise) and a separate Webgility E-commerce account subscription. E-commerce integration subscription will be billed directly from Webgility. Your Webgility account will automatically be charged the package price on a monthly or annual basis, starting at sign up, until you cancel. To cancel your E-commerce subscription at any time, log into your Webgility account customer portal or contact Webgility customer success team at customersuccess@webgility.com or by call 877.753.5373 ext. 2. Your cancellation will become effective at the end of the monthly billing period and your subscription will terminate at that time. You will not receive a prorated refund; your access and subscription benefits will continue for the remainder of the billing period. Cancellation or termination of QuickBooks will not automatically cancel your Webgility subscription.

6QuickBooks Payments account subject to eligibility criteria, credit and application approval. See Important Info, Pricing, Acceptable Use Policy and Merchant Agreement. Access to features above may require download of the latest QuickBooks update.

7QuickBooks Payments account subject to eligibility criteria, credit and application approval. See Important Info, Pricing, Acceptable Use Policy and Merchant Agreement. Access to features above may require download of the latest QuickBooks update.

8Available to QuickBooks Desktop Assisted Payroll users. Payroll processed before 5:00 PM PT shall arrive the same business day (excluding weekends and holidays). Requires setup of direct deposit and bank verification. Next-day direct deposit may be subject to eligibility criteria. Deposit delays may vary because of third party delays, risk reviews, or issues beyond Intuit’s control. Direct deposit service is free for W-2 employees with your Payroll subscription. Additional fees apply for 1099 contractors paid by direct deposit.

9Upgrades to a new version will be provided if and when they become available.

10Available from 6am-6pm Mon-Fri for Pro, Premier, Mac and Plus customers. Enterprise access available 24/7. Hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. Holidays and events beyond our control. Access to messaging with live experts or call back support requires a QuickBooks Care Plan, and internet connection. Care plan is included with Plus and Enterprise subscriptions. A la carte Annual Care Plan MSRP is $299.99

11QuickBooks data recovery service will try to help you recover your data should your company file experience data loss or corruption. Full recovery of corrupt or damaged files is not guaranteed.

12Online services vary by participating financial institutions or other parties and may be subject to application approval, additional terms, conditions and fees.

The post New and improved features in QuickBooks Desktop 2022 appeared first on QuickBooks.