You might’ve heard your grandparents talk about how the prices of goods and services used to be way cheaper, and you might have imagined how great it would’ve been to pay 5 cents for a cup of coffee or even 30 cents for a gallon of gas. So why have prices skyrocketed since then and why do you have to pay almost ten times more? The answer for that is inflation.

Understanding inflation is important because it impacts every aspect of the economy, from consumer spending to investment returns. Since consumer prices are expected to rise 4.8% within the next year, meaning you will soon be paying more for things such as housing and groceries, learning what to expect from the future can help you better manage your finances. In this guide, we’ll break down what the inflation rate is with simple terms, so you can know how to calculate inflation using the inflation rate formula.

What is Inflation Rate?

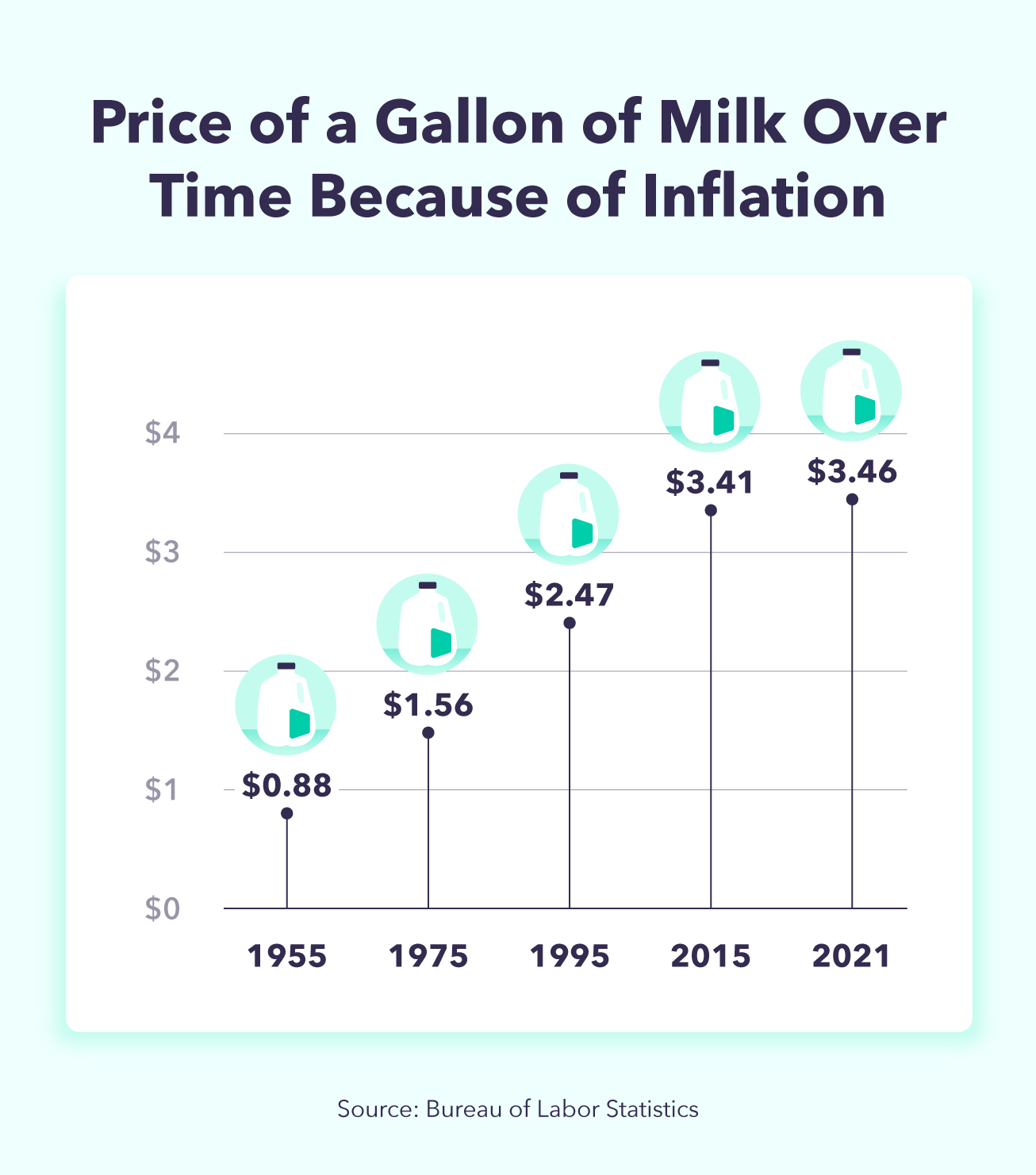

Inflation is the concept that the prices of goods and services increase over time, reducing the value of the currency.

Let’s say you had $7 saved up in your wallet and you wanted to buy a gallon of milk. If you decided to buy it now and it costs $3.50, you could buy two gallons of milk. However, if you decide to save the $7 in your wallet and use it to purchase milk later, there’s a chance that the gallon of milk won’t cost $3.50 anymore. Instead it could cost $3.80, allowing you to buy only one gallon of milk. This means that your purchasing power decreased because of inflation.

As a consumer you are participating in the economic cycle, and knowing the basics of inflation is important for you to understand how the cost of living fluctuations impact your wallet over time.

Why Inflation Happens

The changes in prices due to inflation can occur in every industry, and at any time. Typically, inflation happens due to an increase in production costs or an increase in demand. Price fluctuations can happen for a variety of reasons, such as excess printing of the dollar, and sometimes the price of one good will rise and another could drop.

Generally, the many factors that can cause inflation can be classified into three categories:

Demand-Pull Inflation

When there is more of a demand for goods and services than what the economy is able to produce.

Example: Consumers want to buy milk but farmers don’t have enough supply, resulting in the price of milk going up.

Cost-Push Inflation

When the costs to produce goods and services increase, causing the prices for those goods and services to also increase.

Example: The tools and materials needed to produce milk increased in price, which causes the price of the milk to increase as well.

Built-In Inflation

When workers expect their salaries to increase in order to maintain their living costs because the prices of goods and services have increased. These workers constantly anticipate prices to rise and demand higher salaries, which contributes to the prices of goods and services rising.

Example: The price of milk increases, and consumers want to be able to afford the milk, so they request their salary to also increase.

The Consumer Price Index

The most common index and indicator of inflation is the Consumer Price Index (CPI), which is completed by the U.S. Bureau of Labor Statistics. The CPI is used to assess the changes in cost of living over time. The price of each item — such as milk, eggs, energy, clothing, transportation, and medical expenses — is taken and averaged on a monthly basis. Then the CPI is calculated by dividing the price of a market basket in a particular year by the price of the same basket in the base year.

The Consumer Price Index is based on the index average from 1982 until 1984, which was set to 100. Therefore if you see a CPI reading of 140, it indicates a rise of 40% in the inflation level. If the reading was 250, the inflation level indicates a rise of 150%.

Inflation Rate Formula

In order to calculate the inflation rate you have to use the inflation rate formula. This is a simple formula that allows you to see the percentage of increase or decrease in cost between given years. Once you understand the inflation rate, it’s easier to create a budget.

In the formula, A would be the starting point in the Consumer Price Index for a specific good or service, which could either be a specific year or month. And B would be the current recording in the Consumer Price Index for this same good or service.

To use the formula, subtract A from B to find out how much the price of that specific good or service has changed. Then divide the result by A (the starting price) which will leave you with a decimal number. Convert the decimal number into a percentage by multiplying it by 100. The result is the rate of inflation!

How to Find Inflation Rate for a Period of Time

Now that you understand how the inflation formula works, you might want to find out what the inflation rate was for a period of time in the past or even have an estimate of what you could be paying for something in the future. Here are the steps you can use on how to find inflation rate:

Step 1: Decide What You Want to Calculate

Decide which goods or services you want to analyze and the period of time you want to find out the inflation for. To do so, you can do your own research or gather average prices data from BLS.

How to do it: Let’s say you want to calculate the inflation rate of a gallon of milk from December 1995 to June 2020. If you go to the CPI average data for milk, you will see that the average price for a gallon of milk was $2.518 in December 1995, and in June 2020 it was $3.198.

Step 2: Write Down the Information

Once you have decided what you want to calculate, write it down neatly or create a chart. Make sure you have the price of the good or service for the starting date you decided on as well as the price for the later date.

December 1995

June 2020

$2.518

$3.198

Step 3: Label the Price Points

Now that you have the information written down, you will notice that the formula contains the letter A and B. Label the price for the beginning date as A, since that is the starting number in your formula. Next, label the second price as B, since that is the ending number.

How to do it:

December 1995

June 2020

$2.518 = A

$3.198 = B

Step 4: Plug It in The Inflation Formula

The last step is to simply plug it in the inflation formula and do the calculations. You will subtract the starting price (A) from the later price (B), and divide it by the starting date (A). Then multiply the result by 100 to get the inflation rate percentage.

How to do it:

Inflation Rate = ((B – A) / A) x 100

Inflation Rate = ((3.198 – 2.518) / 2.518) x 100

Inflation Rate = (0.68) / 2.518) x 100

Inflation Rate = (0.27) x 100

Inflation Rate = 27%

How to Find Inflation Rate Using a Base Year

When calculating inflation from a period of time, you are finding the percentage change from the starting date, which would be your base year. However, you can use any year as a base year to calculate the inflation rate. By picking a different year, the index would also be considered 100.

Step 1: Find the CPI of What You Want to Calculate

Decide which goods or services you want to analyze and the years you want to find out the inflation for. To do so, you can use the historical average prices data or gather CPI data from BLS.

If you decide you want to calculate using the average price of a good or service, you will first have to find the CPI for each of them by picking a base year and using the CPI formula:

Value of current market basket

CPI = –––––––––––––––––––––––––––––––– X 100

Value of basket in the base year

How to do it: Let’s say you want to calculate the inflation rate of a gallon of milk from January 2020 to January 2021, and you pick January 2019 as your base year. If you go to the CPI average data for milk, you will see that the average price for a gallon of milk was $3.253 in January 2020, in January 2021 it was $3.468, and the base year price (2019) was $2.913.

Now you have to calculate the CPI for each of these years:

January 2019 (base year): (2.913 / 2.913) x 100 = 100

January 2020: (3.253 / 2.913) x 100 = 111

January 2021: (3.468 / 2.913) x 100 = 119

Step 2: Write Down the Information

Once you have found the CPI numbers, write them down neatly or create a chart. Make sure you have the CPIs for the good or service for the starting date, the later date, and the base year.

How to do it:

Date

Price

CPI

January 2019 (base year)

$2.913

100

January 2020

$3.253

111

January 2021

$3.468

119

Step 3: Label the Price Points

Now that you have the information written down, you will label the CPI for the beginning date as A, since that is the starting number in your formula. Next, label the CPI for the second date as B, since that is the ending number.

How to do it:

Date

Price

CPI

January 2019 (base year)

$2.913

100

January 2020

$3.253

111 = A

January 2021

$3.468

119 = B

Step 4: Plug It in The Inflation Formula

Now simply plug it in the inflation formula and do the calculations. First, subtract the CPI from the beginning date (A) from the later date (B), and divide it by the CPI for the beginning date (A). Then multiply the result by 100 to get the inflation rate percentage.

How to do it:

Inflation Rate = ((B – A) / A) x 100

Inflation Rate = ((119 – 111) / 111) x 100

Inflation Rate = (8) / 111) x 100

Inflation Rate = (0.072) x 100

Inflation Rate = 7.2%

More Examples for How to Calculate Inflation Rate

1. You want to find out the rate of inflation for bananas in March 2014 compared to July 2001. If the price of a pound of bananas was $0.52 in July 2001 and in March 2014 it was $0.59, the calculations would be as follows:

Start date: July 2001. Price: $0.52 = A

End date: March 2014. Price: $0.59 = B

Inflation Rate = ((B – A) / A) x 100

Inflation Rate = ((0.59 – 0.52) / 0.52) x 100

Inflation Rate = (0.07) / 0.52) x 100

Inflation Rate = (0.07) / 0.52) x 100

Inflation Rate = (0.1346) x 100

Inflation Rate = 13.46%

2. Now let’s find the rate of inflation for gasoline in July 2021 compared to January 2002. The price of gasoline was $1.13 per gallon in January 2002, and in July 2021 it was $3.23. You would first subtract $1.13 (A) from $3.23 (B), which is 2.1 and divide that by 1.13 (A), resulting in 1.8584. To get the percentage, you multiply it by 100, and the rate of inflation for gasoline in July 2021 compared to January 2002 is 185.84%, meaning that the price for a gallon of gas more than doubled.

3. If you want to find the inflation rate for electricity in January 2018 compared to January 2010. The CPI for electricity in 2010 was 191.083, and in 2018 it was 213.023. You would first subtract 191.083 (A) from 213.023 (B), which is 21.94, and divide that by 191.083 (A), resulting in 0.1148. Multiply it by 100 to get the percentage, which will be 11.48%.

Now that you know the inflation rate formula and how to use it, you can apply it when making financial decisions. As a consumer, practicing how to use the formula and understanding how inflation works will help you make important decisions regarding your cost of living and your future.

Sources: Bureau of Labor Statistics

The post The Inflation Rate Formula & How to Calculate It appeared first on MintLife Blog.